Partner-Fallstudie: Morgen

Tl;dr - Short Form

lemon.markets offers FinTechs, Banks and Wealth Managers the IT infrastructure for handling securities transactions via an investment API. We are on a mission to open 100 million brokerage accounts across Europe within the next ten years.

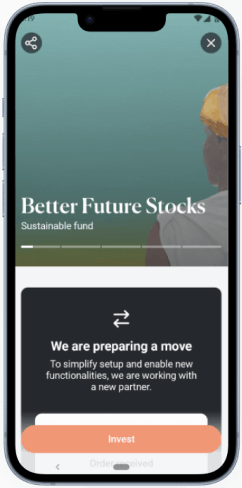

Tomorrow, a sustainable provider for digital banking, strives to create a positive impact by aligning financial products with social, ecological and economical values. Driven by the mission to use money as a force for good, Tomorrow provides its customers with banking and investment products that actively promote a more sustainable future. Their first step in doing so was launching the “Tomorrow Better Future Stocks” fund, which allows customers to invest in companies aligned with the Paris Agreement. Now, they wanted to take the next step: expanding their investment offering and bringing their new vision for sustainable investing to life. Ultimately simplifying their existing investment setup, boosting flexibility for customers and exploring opportunities for future financial products.

And this is where lemon.markets comes into play - giving Tomorrow access to a broader range of investment opportunities, enhanced operational capacities, and regulatory support. Launching this together involved migrating Tomorrow’s customer assets to the lemon.markets platform—meaning lemon.markets now handles investment brokerage, securities custody and order execution, delivering the necessary infrastructure to build and scale Tomorrow’s new vision for sustainable investing.

What was Tomorrow looking for, how does the new setup work—let’s dive into the specifics!

Opportunity

With its “Tomorrow Better Future Stocks” fund, Tomorrow offers an equity fund that aligns with the Paris Agreement and addresses environmental and social challenges. This equity fund allows customers to invest exclusively in sustainable companies. To elevate its investment offering and meet growing customer demand, Tomorrow needed a partner capable of supporting both their current fund and future ambitions. They sought a flexible, scalable solution to streamline their existing operations while providing access to a broad universe of investment assets.

Solution

To realize this vision, Tomorrow partnered with lemon.markets, who now handle their entire investment value chain, including investment brokerage, trading and custody of securities, capital market access and the liability umbrella. Consequently, Tomorrow leverages lemon.markets’ comprehensive range of regulatory, technical and operational capacities to power the “Tomorrow Better Future Stocks” fund and potential future investment products.

Result

Tomorrow’s customers and assets were migrated to lemon.markets’ platform, providing them with greater flexibility and efficiency in their investment offering. With access to a modern infrastructure and real-time processing capabilities, Tomorrow is now equipped to explore new financial products and services, pushing their vision for sustainable investing forward. This partnership allows Tomorrow to focus on what they do best—building products with a sustainable edge—while relying on lemon.markets to provide the infrastructure that underpins their investment platform.

Long form (if you brought a bit more time)

Let us walk you through the journey of how we made this happen and what migrating customers, providing infrastructure and much more REALLY means. Starting from the beginning...

Investing for a better future

The sustainable banking provider Tomorrow was launched in 2018 by Inas Nureldin, Jakob Berndt and Michael Schweikart with the vision of leveraging money as a force for positive change.

By offering sustainable current accounts and the “Tomorrow Better Future Stocks” fund—an equity fund aligned with the Paris Agreement and focused on addressing environmental and social challenges—Tomorrow aims to make a positive impact and build a community of like-minded customers committed to a better world.

If the world economy was composed like the “Tomorrow Better Future Stocks” Fund, we as a society would meet the 2-degree target.

Inas Nureldin, Co-Founder and Co-CEO of Tomorrow

A new chapter for Tomorrow's sustainable investment products

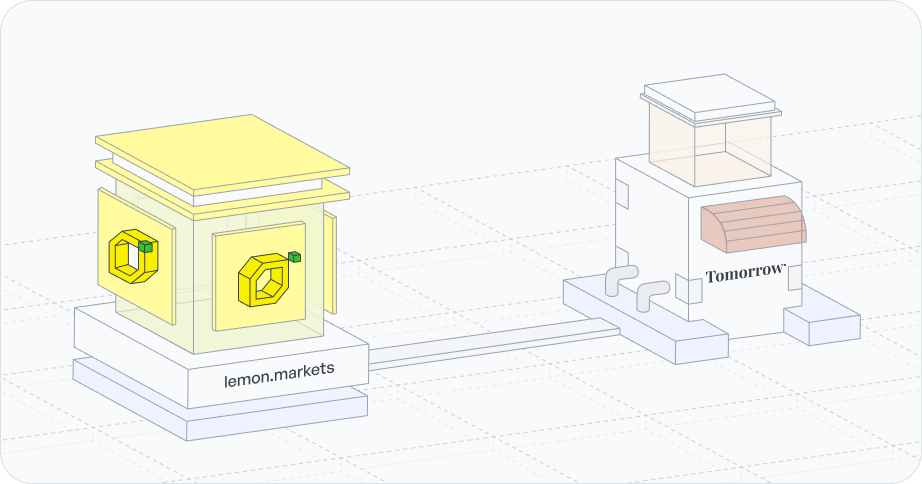

Tomorrow was looking for a future-proof partner helping them expand their product and realize their vision for sustainable investing. To enable Tomorrow to take this next step, lemon.markets facilitated the migration of their customers to a modern platform and handled the technical and regulatory complexities.

We are very excited about the partnership with lemon.markets in which we see great potential for further expansion of our investment offering. With this collaboration, we are also simplifying our investment setup by consolidating our services: Moving away from our previous setup involving three partners, lemon.markets offers all services as a single source.

Inas Nureldin, Co-Founder and Co-CEO of Tomorrow

There are two key advantages of this partnership:

- Comprehensive solution: With lemon.markets, Tomorrow can now offer the entire investment value chain from a single source, streamlining their investment setup and enhancing efficiency.

- Expanded product offering: The partnership enables Tomorrow to introduce new investment products including savings plans in the future, growing investing opportunities for their customers, tailored to their individual needs.

We are happy to support an established FinTech like Tomorrow with our infrastructure. By migrating Tomorrow to our Brokerage-as-a-Service platform, we are simplifying its existing setup and jointly offer sustainable investment products for Tomorrow's customers.

Max Linden, Founder and CEO of lemon.markets

The infrastructure powering investment products

As an infrastructure provider, lemon.markets covers the entire investment value chain for Tomorrow: As such, lemon.markets handles the investment brokerage, trading, and custody of securities, access to the capital market and the liability umbrella for Tomorrow. In addition to concluding all new securities transactions, the collaboration also includes migrating the securities accounts of existing Tomorrow customers.

So what is it exactly that lemon.markets has built for Tomorrow?

lemon.markets has built an onboarding flow, leveraging a KYC Reliance approach. This means customers that have already been KYCed by Tomorrow’s banking partner agree to transmit their data to lemon.markets. Customers can thus be onboarded to lemon.markets without providing their data and doing video-identification (again), greatly improving the overall experience and scalability of the customer onboarding.

Fund Settlement refers to the process of exchanging the correct amount of shares of a fund (such as those held by Tomorrow’s customers) to the corresponding amount of cash. In this specific case, lemon.markets ensures that when a Tomorrow customer buys or sells shares in the “Tomorrow Better Future Stocks” fund, the right amount of shares is exchanged for the right amount of cash between the parties involved, which includes Tomorrow, their banking partner and the fund distributor Allfunds. This process is essential for accurately reflecting transactions in the customer's portfolio and ensuring that investments are correctly recorded and managed.

Cash Settlement, on the other hand, involves the actual transfer of money (cash) in exchange for shares purchased or sold. In simpler terms, it’s the process of ensuring that when a customer places an order to buy or sell shares, the correct amount of money is transferred to or from their account. lemon.markets handles this process, ensuring that the cash flows align with the shares being bought or sold, maintaining the integrity of the transaction.

During the Migration process, lemon.markets is responsible for transferring all customer data and assets from the previous partner to their platform. This involves ensuring that each customer's assets are accurately transferred in the correct quantities and with the appropriate details. The process is meticulously managed to prevent any data loss or errors, ensuring a seamless transition of Tomorrow’s customers to lemon.markets’ platform without disruptions in their investments.

The new setup with lemon.markets

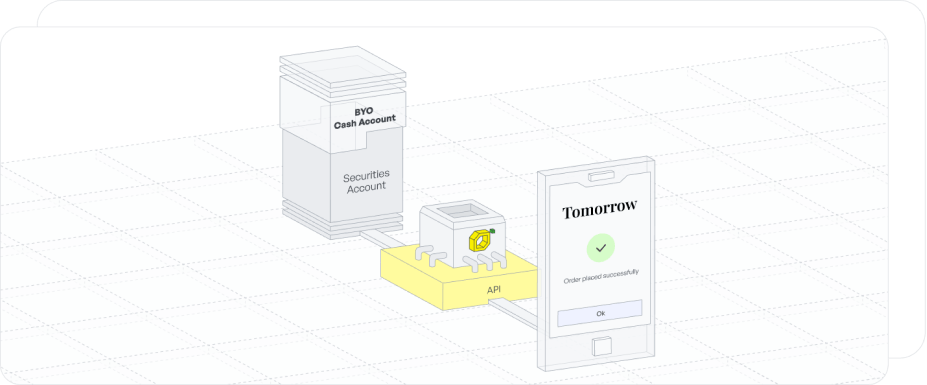

The Target Operating Model, or TOM, is the setup in which the lemon.markets API facilitates custody and brokerage offerings from partners like Tomorrow for their customers. This setup can be viewed from two distinct perspectives - the product perspective and the legal perspective. Let’s have a look!

Product perspective

In the unbundled setup, partners supply banking solutions to their customers and integrate with

lemon.markets for brokerage services. This means that lemon.markets provides partners with a Securities Account, but the partner uses either its own Cash Account or an existing 3rd party Cash Account. In the Operating Model for Tomorrow, the customer cash accounts are provided by their banking partner, who also acts as KYC reliance partner.

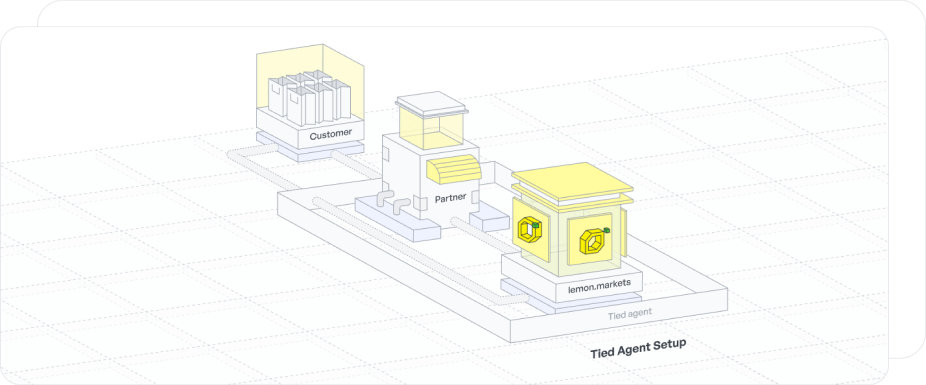

Legal perspective

Tomorrow is utilizing lemon.markets’ platform for custody and order execution of their “Tomorrow Better Future Stocks” fund. This also includes a tied agent relationship to offer investment services within Tomorrow’s banking app using the licenses of lemon.markets. Meaning, Tomorrow leverages the comprehensive offerings of lemon.markets with all regulatory, technical and operational capacities to bring their own investment service to the market - powered by lemon.markets.

The tied agent, Tomorrow, operates under the supervision and liability of a licensed institute (in this case lemon.markets), which supports the tied agent through an outsourcing relationship, allowing the tied agent to offer investment services. In this setup, the contractual customer relationship for the investment services, including order processing and securities safekeeping, lies with lemon.markets. Meanwhile, Tomorrow handles customer acquisition, first-level customer support and the front-end experience, acting as the “face to the customer”.

Tailored Product Offering to Meet Partner Needs

To enable a successful partnership with Tomorrow, lemon.markets expanded its product offering to include mutual funds.

Therefore, lemon.markets developed a seamless integration with the fund distributor Allfunds. This integration allows Tomorrow’s customers to easily buy and sell funds within their app, ensuring smooth and frictionless transactions.

As illustrated in the investment flow below, lemon.markets handles order processing from start to finish. When a customer places an order through Tomorrow’s interface, lemon.markets receives and routes it to Allfunds. Allfunds then processes the transaction, sending back a confirmation of order execution. This seamless workflow enhances the customer experience, ensuring a simple and efficient investment journey at every touchpoint.

Partnership for long-term growth

The new, streamlined setup of Tomorrow’s investment offering, enabled by lemon.markets, allows the digital banking provider to respond more swiftly and with greater flexibility.

lemon.markets’ expertise in handling the technical and regulatory complexities, along with their support in migrating our customers to a modern platform, allows us to focus on providing best-in-class solutions and experiences for our customers.

Inas Nureldin, Co-Founder and Co-CEO of Tomorrow

And this is just the beginning of the partnership between lemon.markets and Tomorrow. Looking ahead, lemon.markets will continue to support Tomorrow in realizing their product vision by introducing new investment products and asset classes. Ultimately allowing Tomorrow to drive sustainable wealth generation and delivering a top-notch investing experience allowing them to meet the needs of their customers—expanding opportunities for responsible investing in the future. All paying into the mission of growing investing opportunities.